Basics

In the factor model, we use sample mean of returns to estimate expected returns \(\boldsymbol{\hat \mu}\) and covariance \(\boldsymbol{\hat V}\). However, the mean-variance portfolio can be very sensitive to these estimation of parameters. Since the estimation usually incorporates noises, which leads to large volatility in portfolio weights. This is what we want to avoid.

Shrinkage

Sample mean is indeed an unbiased estimator, while shrinking it towards a target can offer us some advantages with this bias. Denote two additional parameters, for which we have \(w\) as the shrinking intensity and \(\mu_0\) as the shrinking target. \(\overline{\mathbf{r}}\) is our original sample mean estimates. Then \(\hat{\boldsymbol{\mu}}\) is a better estimate.

The techniques are used in many scenarios, and the optimal \(w\) and \(\mu_0\) depends on the situations. For example, for predicted betas we have, that is to shrink towards the target \(1\).

Just note that here \(\overline{\boldsymbol{\beta}}\) is not the "sample" mean, but just a vector of historical estimated regression betas.

For covariance, we also have a similar setup,

Black-Litterman Model

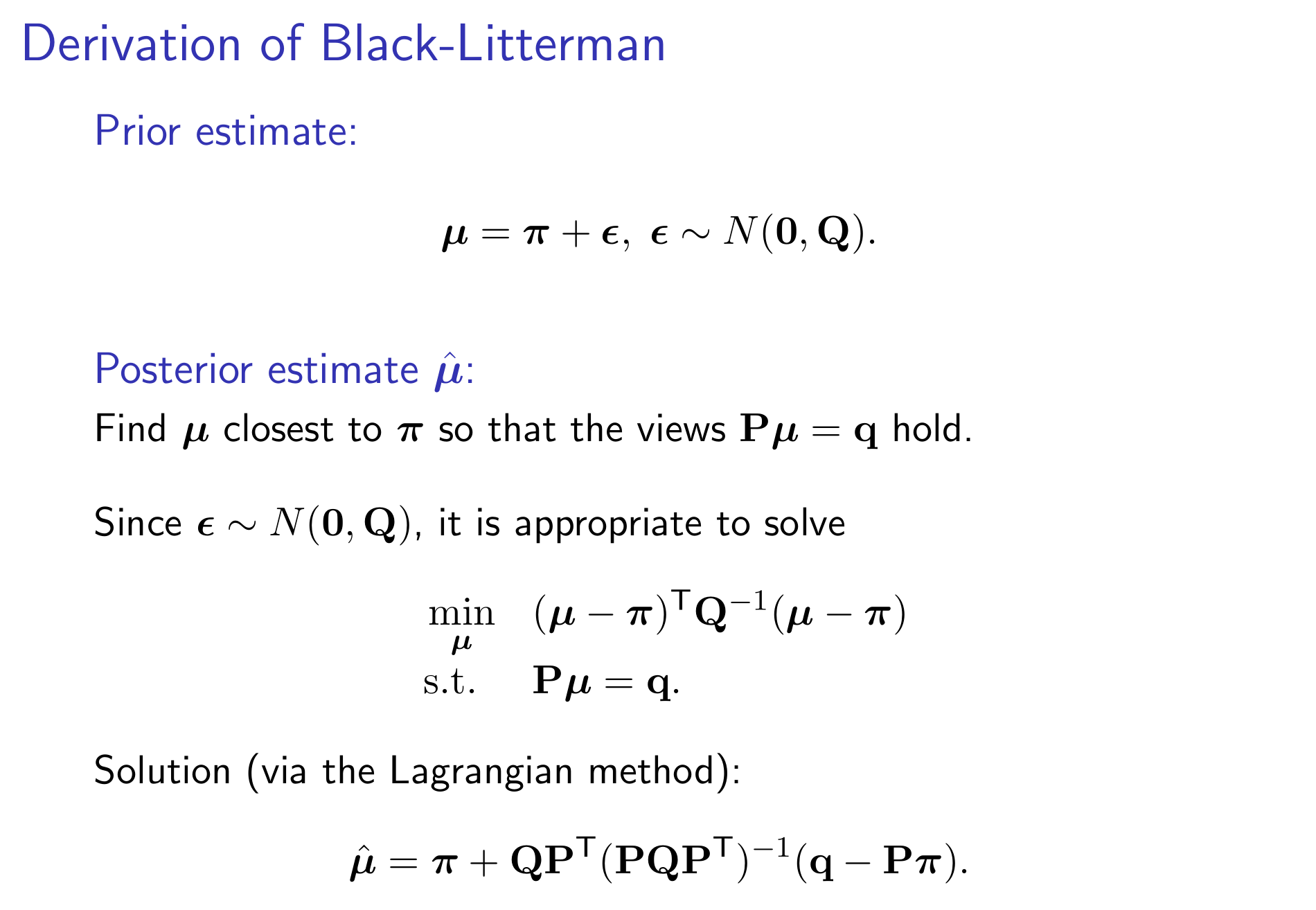

Black-Litterman model incorporates views into the parameter estimations. Though you have a prior estimate, but you are able to transform it to vector \(\mathbf{q}\). We want the impact by this adjustment be as small as possible, so the above formulation comes.