Mean Variance Portfolio

Mean Variance Portfolio

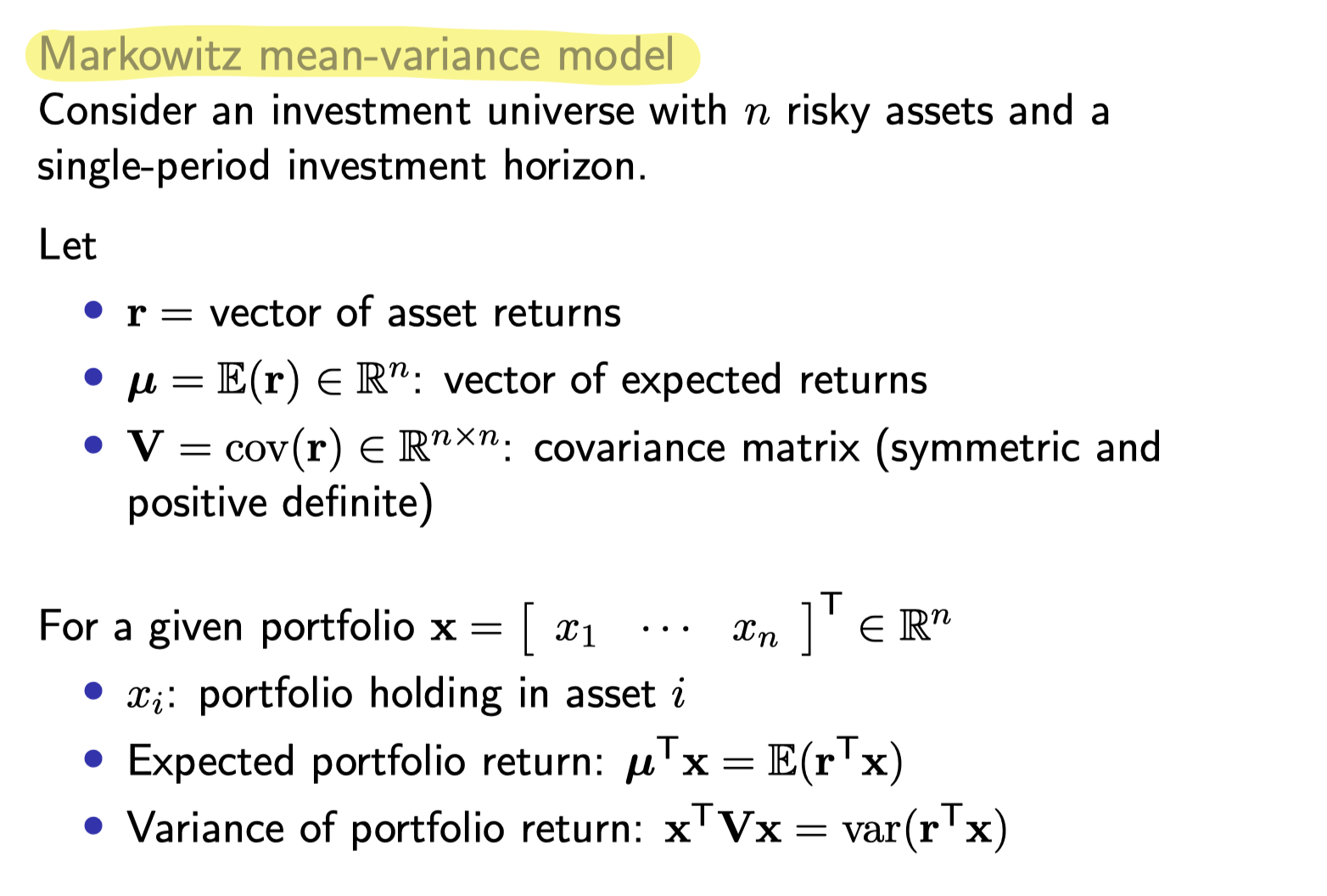

For the variance of the portfolio return, notice that the vector of asset returns \(\mathbf{r}\) is the vector of random variable, instead of the allocation vector \(\mathbf{x}\). Recall the following to see why the matrix form makes sense,

\[

\mathbf{x}^{\top} \mathbf{V} \mathbf{x}=\sum_{i=1}^n \sum_{j=1}^n \sigma_{i j} x_i x_j=\sum_{i=1}^n \sigma_{i i} x_i^2+2 \sum_{i=1}^n \sum_{j=i+1}^n \sigma_{i j} x_i x_j

\]

Minimum-Variance Fully-invested Portfolios

In the previous "two special cases" discussion, we showed that the following problem,

\[

\begin{array}{ll}

\min _{\mathbf{x}} & \mathbf{x}^{\top} \mathbf{V} \mathbf{x} \\

& \mathbf{1}^{\top} \mathbf{x}=1

\end{array}

\]

Has a solution \(\mathbf{x}^{\star}=\frac{1}{\mathbf{1}^{\top} \mathbf{V}^{-1} \mathbf{1}} \mathbf{V}^{-1} \mathbf{1}\).

Maximizing the Sharpe Ratio

The Sharpe ratio of portfolio,

\[

\frac{\mathbb{E}\left(\mathbf{r}^{\top} \mathbf{x}\right)}{\sigma\left(\mathbf{r}^{\top} \mathbf{x}\right)}=\frac{\boldsymbol{\mu}^{\top} \mathbf{x}}{\sqrt{\mathbf{x}^{\top} \mathbf{V} \mathbf{x}}}

\]

To do this optimization problem, we need to transform it into a convex problem, by allowing \(z=\kappa x\), and solve the following,

\[

\begin{array}{cl}

\min _{\mathbf{z}, \kappa} & \mathbf{z}^{\top} \mathbf{V} \mathbf{z} \\

\text { s.t. } & \boldsymbol{\mu}^{\top} \mathbf{z}=1 \\

& \mathbf{A} \mathbf{z}-\mathbf{b} \kappa=0 \\

& \mathbf{D z}-\mathbf{d} \kappa \geq 0 \\

& \kappa \geq 0 .

\end{array}

\]